Why SwissBorg is one of the best apps to invest in Crypto for beginners

Should you invest in cryptocurrencies? I can't answer that for you. The only thing I can say is that many do and so did I. And if you are interested in investing in cryptocurrencies, then SwissBorg is one of the best apps at the moment to do that in my opinion, especially if you are a beginner.

The additional reliability and reputation of Switzerland can make it easier for beginners to get started.

Don't over-engineer it

A lot of people want to find the best app and the best cryptocurrency to invest in. While this is understandable and fundamentally not unreasonable, it can quickly lead to paralysis from analysis.

I have personally experienced this with so many friends: They spend an hour researching crypto and then they don't really do anything. A year later, they complain that they did not get into the game last year and ask:

Is it not too late now to invest in cryptocurrencies?

Introducing SwissBorg

As you might know, I prefer writing about things I have tried and use regularly myself. And SwissBorg is one of them. I started using SwissBorg myself in early 2021. This means I was definitely not one of their first users as their journey started in 2017 already.

SwissBorg is headquartered in Lausanne, Switzerland, so it is superficially regulated in Switzerland and has to follow Swiss contract law. It is a bit hard to say how of a benefit that will be in practice, but I find it makes me sleep a bit better. In the current crypto ecosystem that is still sort of a "wild west", it is great to know where the team and company is headquartered and where you could, at least theoretically, find them if ever necessary.

Invest CHF directly into cryptocurrencies

The main motivation for me was to find an easy way to invest Swiss Francs (CHF) directly into cryptocurrencies.

Previously I would always go through intermediaries like Revolut to convert CHF into EUR and then those EUR on exchanges like Bitstamp into cryptocurrencies. This approach may be OK if you only use Revolut to convert CHF to EUR for crypto investments while you just use a card from neon for purchases in foreign currencies without fees otherwise.

The path through Revolut is a bit of a hassle though. In my own experience, I set a monthly recurring transfer from my main CHF bank account to Revolut and then one from Revolut to Bitstamp.

But I basically had to check manually every month whether the chain of two transfers and currency conversions really worked out. That worked well for like two to three months.

And then it started becoming super annoying.

It was further complicated that at that time I was also still using Revolut as my main card and would quickly reach the 1250 CHF of monthly free conversion from CHF to other currencies.

While you might stay within the limits at low monthly investment sums and while you don't travel much outside of Switzerland, you will quickly reach the limit if you travel anywhere else in Europe.

With the foreign exchange markup fee of 0.5% beyond Revolut's monthly 1250 CHF allowance , it was not such an attractive deal anymore.

So I was looking for a more direct and less complex way to go about this.

And the fact that SwissBorg was from and based in Switzerland was also nice.

Lower fees from direct swaps between all fiat and crypto currencies

Most platforms allow you to trade crypto currencies against some fiat currencies and a few crypto currencies like BTC or Tether.

What if you have Uniswap (UNI) tokens and you want to convert them into Curve DAO (CRV) tokens?

On Bitstamp for example, you could trade the Uniswap tokens into Euros and then Euros into Curve tokens. But you can't go from UNI to CRV directly.

That is not only a bit inconvenient, it also often means more fees since usually you need two transactions, whereas with SwissBorg you can swap directly.

Whether you really profit from this depends of course on how much you use this kind of crypto to crypto swap and also on your tier that you have with SwissBorg or your alternative exchange. One factor not to forget is that SwissBorg tends to have higher basic tier fees than some others like Bitstamp.

Downside: You need to invest in quite some CHSB to get good fees

The biggest and in my opinion almost only real downside of SwissBorg is the higher fees.

While Bitstamp and many exchanges give you around 0.5% fees per transaction at the most basic tier, SwissBorg charges 1% at the most basic tier.

Their highest tier (Genesis Premium) was only offered until Jan 2022. This one had really great rates, since you could convert fiat to stablecoins and BTC without any fees. Unfortunately, they do not offer this tier anymore to new users.

The highest tier which is still available (Generation Premium) requires you to invest and lock quite some CHSB (SwissBorg's own token) and the rates are mediocre compared to the big exchanges.

If your home currency is the Swiss franc (CHF) and using a service with headquarters in Switzerland, you will not have much alternatives though. All the other alternatives either do not accept CHF (meaning additional fees and effort to convert between CHF and EUR/USD) or are not based out of Switzerland.

So like in the traditional banking world, where you pay higher fees for Swiss bank depots than for depots in the neighboring countries, you pay extra for the Swiss system and reputation here too.

Sign up and download the app

As with most finance apps nowadays, you can sign up to SwissBorg through my link and get some free crypto tokens: https://join.swissborg.com/en/r/raphaeKHB6 (affiliate link through which I get a bonus as well).

The link will guide you through the process of redeeming the code.

Your first deposit in CHF (or EUR)

Next comes your first deposit.

You can either deposit cryptocurrencies or your well-known fiat currencies like CHF and EUR.

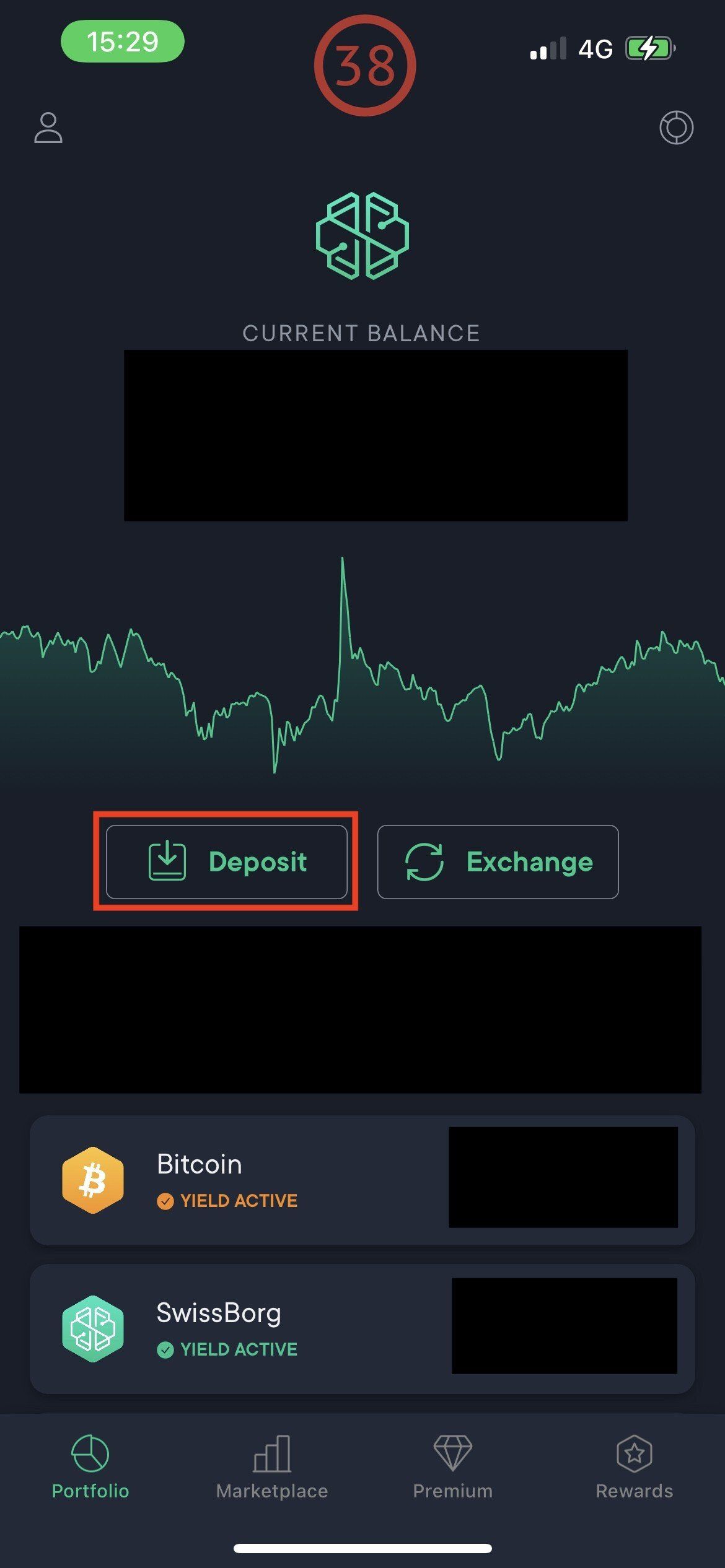

After logging in to the app, you should see the main balance.

Tap

Deposit.

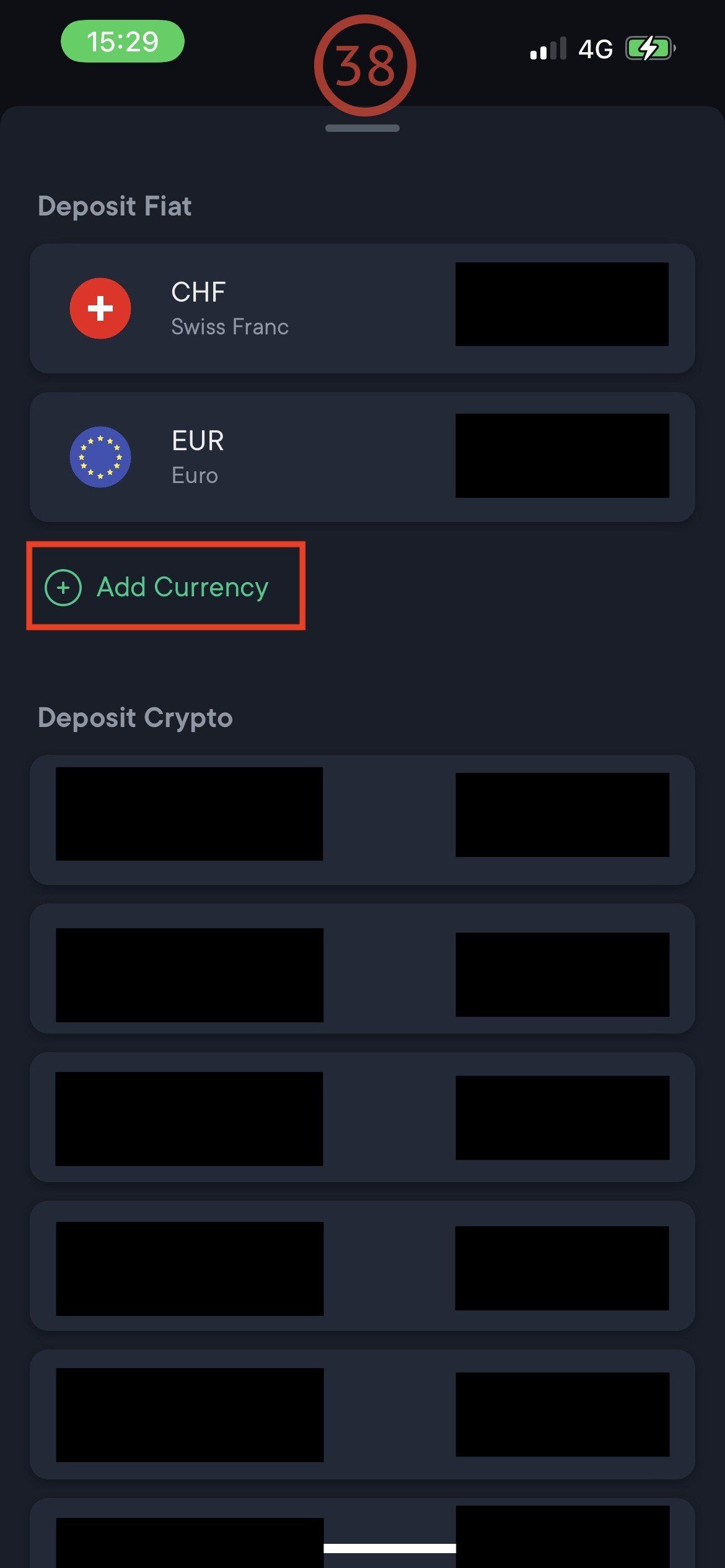

You should then see a selection of fiat (CHF / EUR) and cryptocurrencies to select from the long list.

In my case, EUR and CHF are already at the top because I previously deposited those to my SwissBorg account. You might have to scroll down first to add CHF or EUR.

Click

Add Currency when you do it first to add CHF or EUR.

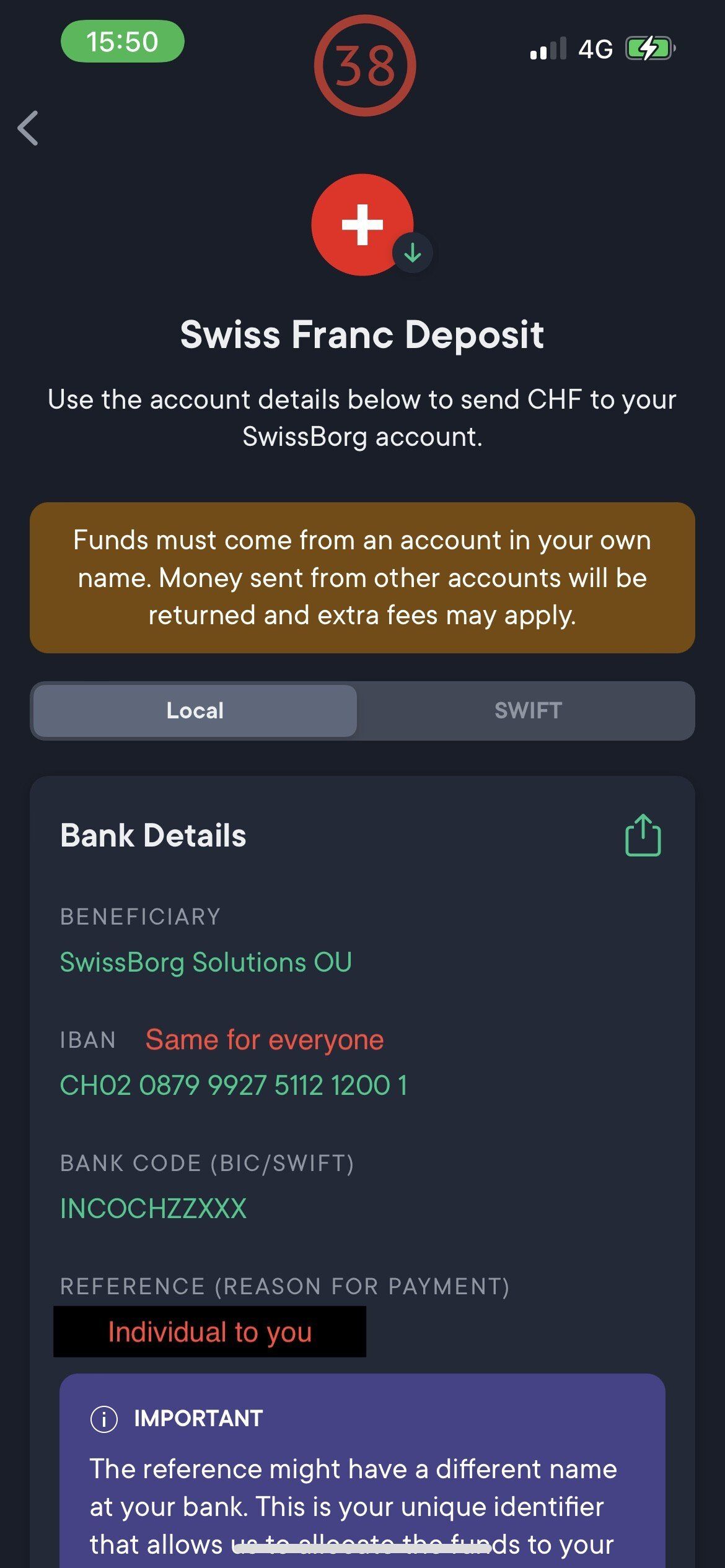

Next up, you will see wiring instructions to transfer your CHF (or EUR) to SwissBorg's bank account.

In the case of CHF, there is only one collective bank account (similar to Revolut), as of March 2022.

So you will have to enter the correct reference number when making the transfer from your bank.

Otherwise the transfer will not be automatically associated with your account.

In the case of EUR, you get a completely individualized IBAN with a payment provider in Malta. In this case, no reference number is required, as of March 2022.

Make sure that the money is sent from a

bank account under your name. If the sender of the money is anyone else, the transfer will not go through. So you can not collect money from friends, clients or business partners in this way. This is especially important when you use payment provider or wallet providers. Sometimes the sender might be the company not you, which will probably make the transfer fail.

If you reached this step, you will definitely have to wait a short while.

When you perform these steps before noon, the Swiss bank transfer might actually arrive within a few hours at SwissBorg. It is a bit hard to predict, but it my scheduled transfers are always there within a few hours max. I presume my CHF bank account sends those in the early morning around 6 or so on the scheduled day and when I wake up the CHF deposit is already completed.

If you deposited EUR and your sending bank supports SEPA Instant Credit, the deposit might even go through within a few minutes. I tried it and the EUR deposit was completed in under an hour in my case.

This article is not financial, tax or legal advice by any means.

I am only sharing my own personal experiences here.

Always seek professional financial, tax or legal advice before making decisions.